Building Wealth Through Property: Real Estate Financing

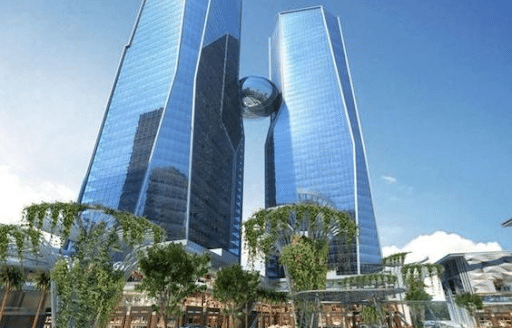

Property Details

For ages, real estate has been a cornerstone of wealth generation. However, obtaining real estate financing can be hard for many people. In this blog, we will delve into the complexities of real estate financing, share insights to help you make informed decisions in this volatile market.

What is Real Estate Financing?

Real estate financing relates to the different processes by which individuals and businesses get property. These techniques almost always require loans, and the terms and conditions might vary greatly depending on the type of property and the borrower’s financial circumstances.

Residential Real Estate Financing

Mortgage Loans

Mortgage loans are the most frequent type of residential real estate financing. Mortgages are long-term loans and are secured by the property. Borrowers make fixed-term payments that include both principal and interest.

Home Equity Loans

Home equity loans enable homeowners to borrow against the equity in their homes. These are utilized to fund home improvements or other expenses.

Commercial Real Estate Financing

Commercial Mortgages

Commercial mortgages are similar to residential mortgages but are suited to corporations acquiring commercial properties. These loans may have more complicated terms and variable interest rates.

Investment Real Estate Financing

Investment Property Loans

Investors can obtain loans to buy properties to generate rental income or capital appreciation. These loans may have more stringent qualifying requirements and higher interest rates.

Real Estate Crowdfunding

A more recent approach in which several investors pool their resources to fund real estate projects. This strategy provides for greater diversification and fewer entry barriers.

Alternative Financing Options

Hard Money Loans

It is a short-term loan. Real estate investors use this to purchase properties quickly. They have higher interest rates and are based on the value of the property rather than the borrower’s creditworthiness.

Seller Financing

In some situations, sellers may be ready to finance a portion of the purchase price. It is a versatile choice, but this necessitates negotiation between the buyer and seller.

What are the Factors Influencing Real Estate Financing?

Creditworthiness

A higher credit score usually results in lower interest rates. Furthermore, lenders need confidence that borrowers will meet their financial obligations. In real estate, where loans often involve substantial sums, a borrower’s creditworthiness helps lenders gauge the risk of default.

Property Type

The sort of property you are financing can impact loan terms and availability. Financing concerns differ for residential, commercial, and investment properties. In addition, property type plays a crucial role in determining the property’s value, which affects the loan-to-value ratio.

Economic Conditions

Economic conditions have a significant impact on the landscape of real estate financing. The current economic climate affects the sector in various ways. To begin with, interest rates, influenced by central bank policies, tend to rise in becoming economies, while economic downturns often see interest rates lowered to encourage borrowing and investment.

Your Trusted Partner in Nigeria’s Real Estate Financing: PropertyListHub

We have shown the particular opportunities and problems of real estate financing in the mosaic of Nigerian Real Estate. With a vast property database, local expertise, user-friendly interface, community insights, and financial tools, PropertyListHub is your key to unlocking Nigerian real estate’s potential. We offer extensive listings that ensure access to options that suit your needs and aspirations. The world of Nigerian real estate awaits – let PropertyListHub be your bridge to success.